Crypto High Rollers: The Evolution of Big Betting in the Digital Age

Aug 07, 2023

Hey there, high roller! Ever wondered how the world of ...

Hey there, high roller! Ever wondered how the world of ...

The time has come to embrace change, folks! Our planet ...

Renewable energy is the future. This statement may sound like ...

Renewable energy is taking the world by storm. People are ...

Renewable energy is some of the most potent and clean ...

In the past few years, the world has been witnessing ...

Renewable resources quickly replace fossil fuels, but do they depend ...

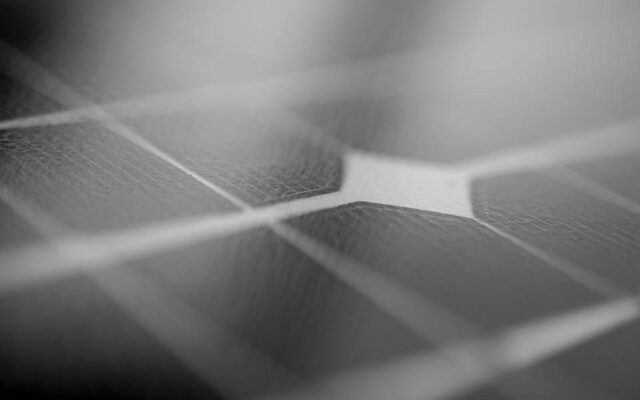

Solar power is the talk of the town these days. ...

Wind energy is a form of solar energy. Due to ...

11+ years’ experience in the renewable energy sector. Developed 500 MW Wind. Constructed 98 MW. Was working on Development of Shopping Mall Projects, ...

Energy expert with more than 20 years of experience in managing innovation and implementing investment strategies in the renewable energy sector.

He is co-chair of the Renewable Energy Committee of the American Chamber of Commerce. He also has experience in various funds with a ...

The company provides professional consulting services in the field of environmental protection and development of wind energy facilities.

740 Zboncak Circle

Langworthland, MA 72415

You need to go down to the subway and. If you are going from the airport, we recommend to get by train - it will save time by about 05-1 hour. If you plan to go by shuttle bus, the total travel time is 2 hours.

Conference catering is offered by the hotel restaurant. Menus for coffee breaks, lunches and dinners are tailored to the latest trends and menu choices for different budgets and events.

Phone : +1 (705) 263-1510

Address : 740 Zboncak Circle, Langworthland, MA 72415